#INTEREST EXPENSE HOW TO#

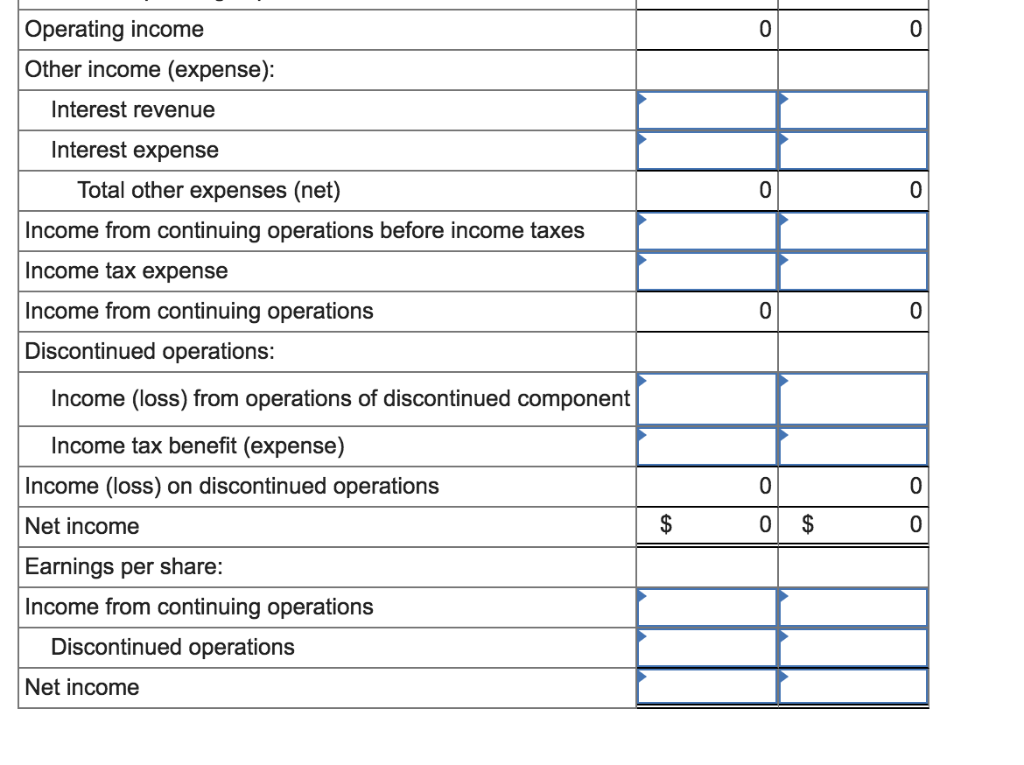

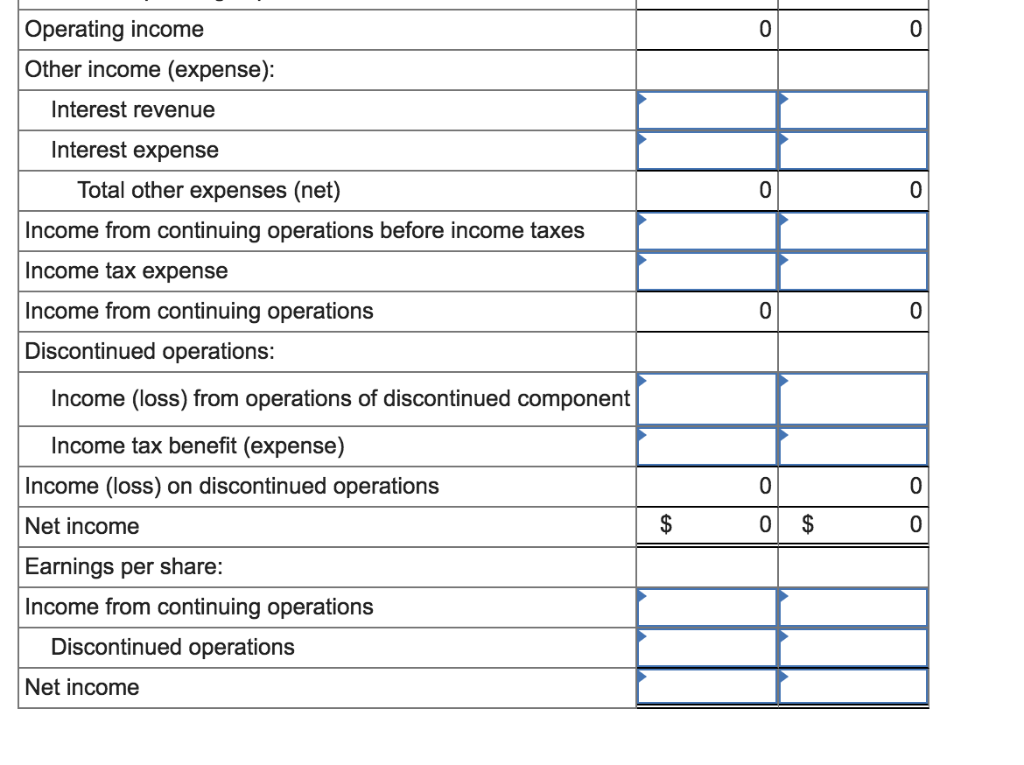

You are free to use this image on your website, templates, etc., Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked Let us see various costs included in different types of debt financing: Calculation of Financing Cost with Examples.read more concerning the financial leasesĬonsider the Income Statement Income Statement The income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements. Usually, this charge is a flat fee, but most of the time it is a percentage of the amount borrowed on an extended line of credit. Finance charges Finance Charges The finance charge, also known as the cost of borrowing or cost of credit, is the accrued interest or fees that have been charged on the approved credit facility.

Foreign exchange differences and fees when the borrowings happen in foreign currency.Amortization of other costs incurred which are related to borrowings.read more based on the borrowings of the Company The excess premium received is amortized by the company over the bond term, and the concept is known as Amortization of Bond Premium.

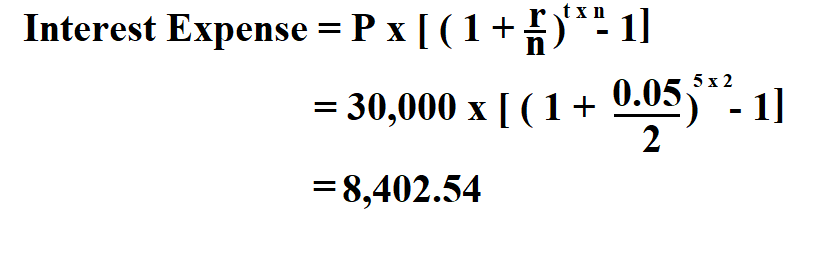

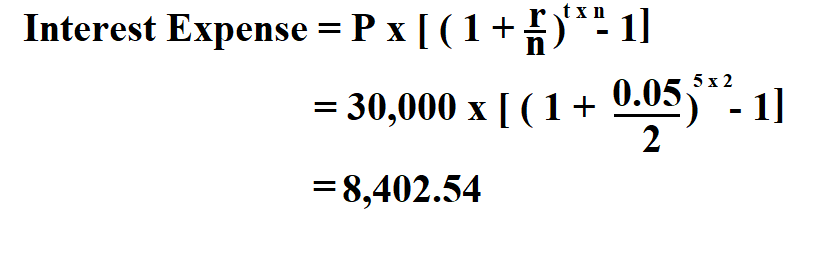

Amortization of discounts and premiums Amortization Of Discounts And Premiums When a company issues bonds to investors with a coupon rate that is higher than the market rate of interest, the investors may bid higher than the face value of the bond. In broader terms, borrowing costs include the following costs other than the interest costs: It include obtaining funds through online loans, credit lines, and invoice financing. read more can be on both short-term financing Short-term Financing Short-term financing refers to financing a business for less than a year in order to generate cash for working and operating expenses, usually for a smaller amount. Interest expense Interest Expense Interest expense is the amount of interest payable on any borrowings, such as loans, bonds, or other lines of credit, and the costs associated with it are shown on the income statement as interest expense. read more require capital gains and dividends for their investments, and debt providers seek interest payments.įinance costs, however, refers to the interest costs and other fees given to debt financers. Equity investors Equity Investors An equity investor is that person or entity who contributes a certain sum to public or private companies for a specific period to obtain financial gains in the form of capital appreciation, dividend payouts, stock value appraisal, etc. None of the financing comes free for the Company. The money raised from the market does not have to be repaid, unlike debt financing which has a definite repayment schedule. Equity Financing Equity Financing Equity financing is the process of the sale of an ownership interest to various investors to raise funds for business objectives. They are also known as “Finance Costs” or “borrowing costs.” A Company funds its operations using two different sources: If a company has $100 million in debt with an average interest rate of 5%, then its interest expense is $100 million multiplied by 0.05, or $5 million.Financing costs are defined as the interest and other costs incurred by the Company while borrowing funds. The simplest way to calculate interest expense is to multiply a company's total debt by the average interest rate on its debts. Companies account for interest as it is charged, not when cash for interest payments actually leaves their coffers. For example, if a company pays $1 million to its creditors and $200,000 is applied toward the principal debt, then the interest expense is $800,000.Ī company's interest expense is included on its income statement and represents the interest accrued - but not necessarily paid - during a certain time period. Also not included in interest expense is any payment made toward the principal balance on a debt. Interest expense does not include other fixed payment obligations of a company such as paying dividends on preferred stock. Interest expense also includes margin interest, which is charged in taxable brokerage accounts when borrowed funds are used to purchase investments. Interest expense refers to the cost of borrowing money and includes a company's interest payments on any bonds, loans, convertible debt, and lines of credit. Image source: The Motley Fool What is interest expense?

Amortization of discounts and premiums Amortization Of Discounts And Premiums When a company issues bonds to investors with a coupon rate that is higher than the market rate of interest, the investors may bid higher than the face value of the bond. In broader terms, borrowing costs include the following costs other than the interest costs: It include obtaining funds through online loans, credit lines, and invoice financing. read more can be on both short-term financing Short-term Financing Short-term financing refers to financing a business for less than a year in order to generate cash for working and operating expenses, usually for a smaller amount. Interest expense Interest Expense Interest expense is the amount of interest payable on any borrowings, such as loans, bonds, or other lines of credit, and the costs associated with it are shown on the income statement as interest expense. read more require capital gains and dividends for their investments, and debt providers seek interest payments.įinance costs, however, refers to the interest costs and other fees given to debt financers. Equity investors Equity Investors An equity investor is that person or entity who contributes a certain sum to public or private companies for a specific period to obtain financial gains in the form of capital appreciation, dividend payouts, stock value appraisal, etc. None of the financing comes free for the Company. The money raised from the market does not have to be repaid, unlike debt financing which has a definite repayment schedule. Equity Financing Equity Financing Equity financing is the process of the sale of an ownership interest to various investors to raise funds for business objectives. They are also known as “Finance Costs” or “borrowing costs.” A Company funds its operations using two different sources: If a company has $100 million in debt with an average interest rate of 5%, then its interest expense is $100 million multiplied by 0.05, or $5 million.Financing costs are defined as the interest and other costs incurred by the Company while borrowing funds. The simplest way to calculate interest expense is to multiply a company's total debt by the average interest rate on its debts. Companies account for interest as it is charged, not when cash for interest payments actually leaves their coffers. For example, if a company pays $1 million to its creditors and $200,000 is applied toward the principal debt, then the interest expense is $800,000.Ī company's interest expense is included on its income statement and represents the interest accrued - but not necessarily paid - during a certain time period. Also not included in interest expense is any payment made toward the principal balance on a debt. Interest expense does not include other fixed payment obligations of a company such as paying dividends on preferred stock. Interest expense also includes margin interest, which is charged in taxable brokerage accounts when borrowed funds are used to purchase investments. Interest expense refers to the cost of borrowing money and includes a company's interest payments on any bonds, loans, convertible debt, and lines of credit. Image source: The Motley Fool What is interest expense?

0 kommentar(er)

0 kommentar(er)